How to Place a Stop Loss Order on Coinbase Pro

One of the most popular American-based cryptocurrency exchanges is Coinbase Pro, formerly known as GDAX. It has all the necessities a trader needs to buy and sell various cryptocurrencies. Buy and sell orders are easy to understand, but one of the more complex order types is called a stop order. In this guide, we’ll show you how to place a stop-loss order on Coinbase Pro.

Does Coinbase Pro support Stop Orders?

Yes, Coinbase Pro does support stop-loss orders. A stop-loss is a conditional order that triggers at a given price. These order types are for automatically selling your crypto if it drops below a given price. The idea is that when the price drops below a certain level, it may keep going. In this scenario, you might want to stop your losses.

How to Place a Stop Loss Order on Coinbase Pro

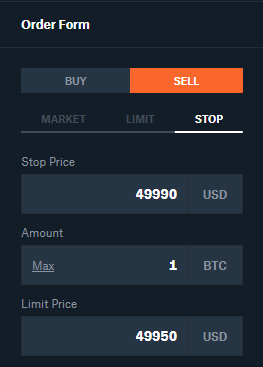

To place a stop-loss order, you’ll need to have an open position. Change the order type from Buy to Sell and select the Stop tab. You will see three fields, and here’s what they mean:

- Stop Price: price at which the order triggers

- Amount: amount you want to sell

- Limit Price: the price at which you will sell

The most confusing part about a stop-loss order is understanding the difference between the stop price and the limit price. Once you grasp that concept, it will all make sense.

Two prices are necessary because one is the trigger (stop), and the other is your desired price to sell (limit). When the price is dropping, it can happen very quickly and violently—having an automated way to sell your position can result in fewer losses.

For stop-loss orders, you will want to set your limit price slightly below the stop price. The reason is because of something known as slippage. In some scenarios, the price can drop below your stop price if there are no buyers in that range. That’s where the limit price comes into play.

Hypothetical Example

In a hypothetical scenario, I have one Bitcoin, and the current price is $51,000. I feel that if the price were to drop below $50,000, it would go much lower. So, if it drops below $50,000, I want to sell my Bitcoin, but I can’t sit here and stare at the chart all day long.

Instead, I’ll set up a stop-loss order. My stop price will be $49,990, meaning if Bitcoin hits this price, my order will trigger. Other people probably have the same idea, so I’ll give myself some cushion and set my limit price to $49,950. In other words, if Bitcoin reaches $49,990, I will automatically place an order to sell my Bitcoin for $49,950.

“But you’re losing $50! Why not just sell at $50,000?”

Well, I believe $50,000 is a spot where Bitcoin could get to but then immediately go back up. I would be disappointed about selling my Bitcoin if that happened. I only want to sell if the price drops below that point, hence the $49,990 stop price. My $49,950 limit price gives me a $40 cushion to increase the odds that my order goes through and doesn’t get skipped over.